Technology Investment Banking helps tech companies with mergers, acquisitions, and raising capital. Pioneer-technology.com keeps you informed about the latest trends and opportunities in this dynamic field. Stay ahead with detailed insights, expert analysis, and up-to-date information. For detailed insights, explore venture capital, growth strategies, and enterprise solutions on pioneer-technology.com.

1. Understanding Technology Investment Banking

Technology Investment Banking Definition: Technology investment banking involves advising companies in sectors like software, internet, hardware, semiconductors, and IT services on mergers, acquisitions, and debt and equity issuances.

Technology investment banking is a specialized field within investment banking focused on providing financial advisory services to technology companies. This includes assisting with mergers and acquisitions (M&A), raising capital through debt and equity offerings, and providing strategic advice. These services help tech firms grow, innovate, and navigate the complexities of the financial markets. According to research from Stanford University’s Department of Computer Science, technology investment banking will play an increasingly vital role in the growth and development of the tech industry, supporting innovation and expansion.

1.1. What Are the Main Categories Within Technology Investment Banking?

The main categories include early-stage/growth-oriented companies and mature companies. Early-stage firms often seek capital to grow and may eventually aim for acquisition or an initial public offering (IPO). Mature companies, usually large, public entities, frequently acquire smaller firms to innovate and enter new markets. Each type requires tailored financial strategies and advice.

1.2. How Does Deal Structure Vary Between Smaller and Larger Banks?

Deal structure varies significantly depending on the size of the bank. Smaller banks often focus on early-stage companies, leading to more sell-side M&A deals and equity issuances. Larger banks, dealing with mature companies, see more buy-side M&A deals, leveraged buyouts, and debt issuances. This difference shapes the type of experience and skills bankers gain.

1.3. What Geographical Areas Are Dominant in the Tech Industry?

The United States leads with highly valued tech companies like Apple, Microsoft, Amazon, Alphabet (Google), and Facebook. China follows with Alibaba and Tencent. Other Asian countries, such as South Korea, Taiwan, and Japan, also rank prominently due to their hardware and semiconductor companies. Europe has fewer large-cap, public tech companies, but includes notable names like SAP in Germany and Spotify in Sweden.

Global Tech Companies

Global Tech Companies

2. TMT vs. Technology Investment Banking

2.1. What Is the Difference Between TMT and Technology Investment Banking?

TMT stands for Technology, Media, and Telecom, which is a broader category than just technology. TMT includes telecom companies like AT&T and Verizon, and media companies like Disney and ViacomCBS. Technology investment banking focuses specifically on companies providing software, hardware, and IT services. Understanding this difference is crucial for targeting the right career path.

2.2. How Has the Convergence of TMT Sectors Affected the Industry?

The convergence of TMT sectors has blurred traditional lines. For instance, Netflix started as a technology company but has evolved into a media company through original content production. This convergence requires investment bankers to have a broader understanding of different business models and market dynamics.

2.3. Why Focus Solely on Technology Companies?

Focusing solely on technology companies allows for deeper expertise in specific areas like software, hardware, and IT services. This specialization enables investment bankers to provide more tailored and effective advice. For additional insights, visit pioneer-technology.com to explore our specialized content.

3. Recruiting: How To Get Into Technology IB

3.1. Is Technology IB Highly Specialized?

Technology IB is not highly specialized in accounting, valuation, or financial modeling compared to some other sectors. While an engineering or computer science background can be helpful, it is not essential. What matters most is a strong grasp of financial principles and the ability to learn about the specific nuances of the tech industry.

3.2. What Makes the Biggest Impact in Recruiting?

The quality of your program, grades, work experience, and networking efforts are paramount. Investment banks follow a standard recruitment process for both undergrads and MBAs. Building a strong resume and excelling in interviews are crucial for success.

3.3. Are Boutique Banks a Good Entry Point?

Yes, tech-focused boutique banks can be a good entry point. These firms often work with startups and smaller companies seeking funding. However, be aware that you might not gain the same deal or modeling experience as you would at a larger bank. Consider it a stepping stone to bigger opportunities.

4. Day-to-Day Activities in Technology Investment Banking

4.1. What Determines the Day-to-Day Activities of Analysts and Associates?

Your day-to-day activities depend on the vertical and the types of companies you work with. At a boutique bank, you might focus on private placements with limited modeling. At a bulge bracket bank, you’ll likely work on M&A deals and leveraged buyouts involving mature companies. Your role will also involve pitch books and various ad-hoc tasks.

4.2. How Do Activities Differ Between Mature and Early-Stage Companies?

Working with mature companies involves more focus on profitability, cash flows, and breakeven analysis, especially in sectors like IT services and semiconductors. Early-stage companies in internet and software might require more analysis of growth metrics and market potential, even if they are not yet profitable.

4.3. What Skills Are Essential for Success?

Essential skills include financial modeling, valuation, and a solid understanding of the tech industry. Being able to analyze market trends and understand the specific metrics relevant to different tech sub-sectors is also crucial. Continuous learning and adaptability are key in this fast-paced environment.

5. Key Trends and Drivers in Technology

5.1. What Role Do Innovation and Upgrade Cycles Play?

Innovation drives the tech industry, but upgrade cycles can be volatile. Initial product launches, like the iPhone, create huge demand. As innovation slows, the market becomes more about replacements, affecting sales and profit margins. Staying ahead requires constant product improvement.

5.2. How Does (Dis)inflation Impact Tech Companies?

High inflation can disadvantage tech companies because product prices tend to fall over time due to efficient manufacturing and lower material costs. Companies must continuously innovate to maintain profit margins, which is easier with low inflation. Economic conditions greatly influence the industry.

5.3. Why Are Geopolitics and National Security Important?

Technology is increasingly viewed as vital to national security, leading to more regulation. The U.S. and China’s competition affects tech firms globally, as do conflicts like that between China and India. Geopolitical factors impact supply chains, market access, and investment decisions.

5.4. How Do Economic Conditions Affect the Tech Sector?

Technology is highly sensitive to economic conditions. It thrives when unemployment is low, disposable income rises, and businesses invest in IT. During recessions, IT spending is often cut first. Therefore, understanding broader economic trends is essential for predicting the performance of tech companies.

5.5. What Role Do Tax, Trade, and IP Policies Play?

Strong IP protection is crucial for software companies to combat piracy. Tax policies favoring different entities and trade policies affect tech supply chains. These policies impact a company’s ability to operate globally and maintain profitability.

6. Sub-Sectors within Technology Investment Banking

6.1. How Are Tech Groups Typically Divided in Large Banks?

Large banks divide their tech groups in various ways, sometimes with 15 sub-groups or as few as 3-4. Common sub-sectors include Software, Internet, Hardware & Equipment, Semiconductors, and IT Services. This structure allows for specialization and deeper industry knowledge.

6.2. Why Is This Specific Split the Easiest to Explain?

This split is easiest to explain because it aligns with how companies and sector drivers are commonly understood. Each sub-sector has unique characteristics and financial metrics that investment bankers need to master.

6.3. Where Can I Find More Detailed Information on Each Sector?

For more detailed information on each sector, visit pioneer-technology.com. We offer comprehensive analysis and up-to-date insights on each of these key technology areas.

7. Software Sector

7.1. What Are Some Representative Large-Cap Software Companies?

Representative large-cap companies include Microsoft, Oracle, SAP, Salesforce, Adobe, VMware, and Intuit. These firms dominate the software market, often selling to enterprises rather than consumers.

7.2. Why Are There Few Large, Pure-Play Software Companies?

There are relatively few large, pure-play software companies due to consolidation by firms like Oracle and the focus on enterprise clients. Winning enterprise accounts requires significant effort, but they tend to be “sticky,” benefiting large players.

7.3. What Is the SaaS Model, and How Has It Changed the Industry?

The SaaS model involves customers paying a subscription fee to use remotely delivered software. This model provides lower upfront costs for customers and better revenue visibility for companies. It has also changed accounting and financial modeling, requiring familiarity with metrics like CAC, LTV, and Churn.

7.4. What Key Metrics Are Important for Software Companies?

Key metrics include Customer Acquisition Costs (CAC), Lifetime Value (LTV), Churn, Billings, and Unearned Revenue. Understanding these metrics is essential for accurate financial analysis and valuation of software companies. Additional information can be found in our guides to SaaS accounting and ARR on pioneer-technology.com.

8. Internet Sector

8.1. What Are Representative Large-Cap Internet Companies?

Representative large-cap companies include Amazon, Alphabet (Google), JD.com, Facebook, Tencent, Alibaba, Baidu, Rakuten, and Netflix. These companies span various internet services, from social networking to e-commerce.

8.2. What Are the Key Drivers for Internet Companies?

Key drivers include User Growth, Monthly Active Users (MAUs), and Average Revenue per User (ARPU). Social media companies rely on advertising revenue, while others depend on in-app purchases. Marketplace companies focus on Gross Merchandise Value (GMV).

8.3. How Do Metrics Differ for Various Types of Internet Companies?

Metrics vary based on the type of internet company. Social media firms focus on ad revenue and user engagement, while e-commerce companies monitor gross margin and inventory turnover. Subscription-based companies track user growth and churn rates.

8.4. Why Is Gross Merchandise Value (GMV) Important for Marketplace Companies?

Gross Merchandise Value (GMV) represents the total sales volume of transactions on a marketplace site over a specific period, making it a critical metric for assessing the platform’s overall performance and scale. It reflects the total value of goods sold and provides insights into the marketplace’s growth and popularity.

9. Hardware & Equipment Sector

9.1. Who Are the Major Players in the Hardware & Equipment Sector?

Major players include Apple, Samsung, Hon Hai Precision Industry (Foxconn), Huawei, Dell, Hitachi, HP, Lenovo, Cisco, Pegatron, and Xiaomi. These companies are based in the U.S., China, Taiwan, Japan, and South Korea, reflecting the global nature of the industry.

9.2. How Does This Sector Differ from Software and Internet?

Unlike software and internet companies, hardware firms spend heavily on CapEx to build factories and manufacture products. This makes them more similar to industrials companies, focusing on gross margins and cash flows.

9.3. What Factors Are Critical for Hardware Companies?

Supply chains and manufacturing efficiency are critical. Sales channels (direct vs. distributors vs. retail) also play a key role. Many companies are trying to diversify revenue streams with apps and subscription services.

10. Semiconductors Sector

10.1. Who Are the Leading Semiconductor Companies?

Leading companies include Intel, Taiwan Semiconductor Manufacturing Company (TSMC), Micron, Qualcomm, SK hynix, Broadcom, NXP Semiconductors, Applied Materials, Texas Instruments, ASE, ASML, and Nvidia. This sector is crucial for the manufacturing of devices.

10.2. How Do Semiconductor Companies Differ from Hardware Companies?

Semiconductor companies make the “insides” of devices, such as CPUs, memory, and graphics cards, while hardware companies assemble these devices. The semiconductor industry is highly cyclical and requires significant R&D investment.

10.3. What Are Fabless and Fablite Models?

“Fabless” companies outsource manufacturing to reduce expenses, while “fablite” companies mix internal and outsourced manufacturing. These models help companies balance cost efficiency and quality control.

10.4. What Key Metrics Are Used in the Semiconductor Industry?

Key metrics include the book-to-bill ratio (orders received / orders shipped) and capacity utilization. These metrics help gauge where a company is in the industry cycle.

11. IT Services Sector

11.1. Who Are the Major IT Services Companies?

Major companies include IBM, Accenture, Fujitsu, NEC, Visa, NTT Data, Tata Consultancy, DXC Technology, PayPal, MasterCard, Cognizant, ADP, Capgemini, Infosys, and Fiserv. This sector includes IT consulting and data processing services.

11.2. Why Are Visa, PayPal, and MasterCard Included in IT Services?

These companies are included because they fall under the “Data Processing & Outsourced Services” category, heavily relying on technology. They process vast amounts of data and require robust IT infrastructure.

11.3. What Are the Key Drivers for IT Services Companies?

Key drivers include business spending and the ease of outsourcing/offshoring. In the data processing segment, employment levels and consumer spending are important.

12. Valuation and Financial Modeling in Technology

12.1. Are There Significant Differences in Accounting and Valuation in Technology?

While standard methodologies like DCF, comparable company analysis, and precedent transactions are used, there are nuances. You need to understand metrics like deferred revenue, billings, and revenue recognition for SaaS companies.

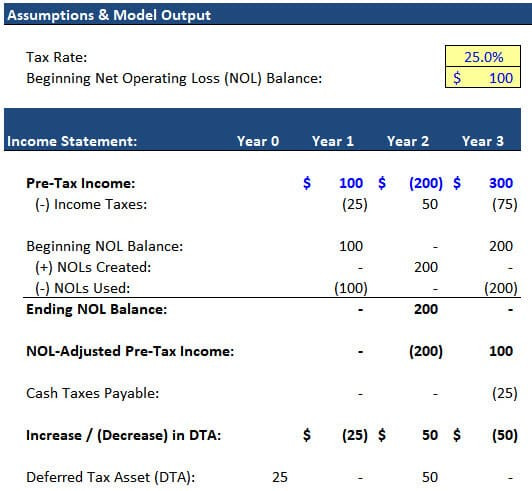

12.2. What Is the Significance of Net Operating Loss (NOL) Balances?

Many tech companies have significant NOL balances, requiring familiarity with how they work and interact with taxes. This knowledge is essential for accurate financial modeling.

12.3. Why Are Convertible Bonds and Preferred Stock Important?

Many tech companies use convertible bonds or preferred stock, so understanding their accounting and valuation is crucial. These instruments can significantly impact a company’s financial structure.

13. Examples of Valuations, Fairness Opinions, and Investor Presentations

13.1. Can You Provide Examples in Software?

Examples include the IBM/Red Hat valuation by Guggenheim and Morgan Stanley, and the Salesforce/Tableau valuation by Goldman Sachs. These documents provide insights into how software companies are valued.

13.2. What Are Some Examples in the Internet Sector?

The Microsoft/LinkedIn valuation by Qatalyst Partners and the Shutterfly leveraged buyout by Apollo, advised by Morgan Stanley, are good examples.

13.3. What Examples Are Available in Hardware & Equipment?

Examples include the Cisco/Acacia valuation by Goldman Sachs and the Xerox/HP (cancelled) deal advised by Guggenheim, Goldman Sachs, and Citi.

13.4. Are There Any Examples in Semiconductors?

Yes, the Infineon/Cypress Semiconductor valuation by Morgan Stanley and the Nvidia/Mellanox valuation by JP Morgan and Credit Suisse are relevant examples.

13.5. What Are Some Examples in IT Services?

Examples include the Fidelity National Information Services/Worldpay valuation by Centerview, Goldman Sachs, and Credit Suisse, and the Fiserv/First Data valuation by JP Morgan, BAML, and Evercore.

14. Top Banks in Technology Investment Banking

14.1. Which Banks Are Known as the Best in Technology IB?

Goldman Sachs and Morgan Stanley are traditionally known as “the best,” but all bulge bracket banks have strong tech/TMT teams. JPM, BAML, and Citi also frequently advise on tech mega-deals.

14.2. What About Middle Market Banks?

Among middle market banks, Harris Williams, William Blair, Jefferies, and Raymond James have strength in tech. These firms provide valuable services to smaller tech companies.

14.3. Which Elite Boutiques Specialize in Technology?

Qatalyst Partners specializes in technology, while Evercore, Lazard, Guggenheim, Centerview, and Moelis also frequently work on tech deals.

14.4. Are There Other Boutique Banks Worth Mentioning?

Yes, there are many boutique banks in the tech space, including Union Square Advisors, GCA, CODE Advisors, Raine Group, FT Partners, Marlin & Associates, Arma Partners, and GP Bullhound.

15. Exit Opportunities in Technology Investment Banking

15.1. What Exit Opportunities Are Available?

Exit opportunities include private equity, venture capital, growth equity, hedge funds, corporate finance, and corporate development. Tech IB provides a broad skill set applicable to many industries.

15.2. How Does Bank Size Affect Exit Opportunities?

Working at a larger bank can open doors to more prestigious roles, such as technology private equity at Blackstone. Smaller banks may lead to opportunities in venture capital, growth equity, or smaller PE firms.

15.3. What Role Does Growth Equity Play?

Growth equity is heavily focused on technology firms, making it a separate and significant exit opportunity. Firms like Summit Partners, TA Associates, TCV, Accel-KKR, Vista Equity, and Vector Capital dominate this space.

16. Is Technology the Best Group?

16.1. Has Technology Dominated the Stock Markets in Recent Years?

Yes, big tech companies have dominated the U.S. and global stock markets over the past decade. However, market leadership changes each decade.

16.2. Will Technology Continue to Conquer the World?

It’s unlikely that the current top tech companies will remain the top companies by market cap in 2030. Calls for regulation and “breaking up big tech” are increasing.

16.3. Could Another Industry Displace Technology?

Another industry could displace tech, especially if biotech becomes the next dominant sector. While tech won’t disappear, its dominance may decrease.

17. Pros and Cons of Technology Investment Banking

17.1. What Are the Pros of Working in Technology IB?

- Variety of deals across different sectors.

- Skills applicable to many industries, leading to good exit opportunities.

- Potential to specialize in PE, HF, VC, or CD roles.

- High deal flow due to active acquirers.

17.2. What Are the Cons of Working in Technology IB?

- Potential to get stuck on boring private placements at smaller banks.

- Sensitivity to economic conditions.

17.3. Is Technology IB a Good Career Choice?

Technology IB is a solid career choice. While the tech landscape may evolve, the skills and experience gained are valuable and transferable. For more insights into career paths in technology, explore pioneer-technology.com.

18. Technology Investment Banking FAQ

18.1. What exactly does a technology investment banker do?

Technology investment bankers advise tech companies on financial transactions such as mergers, acquisitions, and raising capital through debt and equity offerings. They provide strategic advice to help these companies grow and innovate.

18.2. What skills are needed to succeed in technology investment banking?

Key skills include financial modeling, valuation, understanding of the tech industry, and the ability to analyze market trends. Strong communication and interpersonal skills are also essential.

18.3. How is technology investment banking different from other types of investment banking?

Technology investment banking focuses specifically on the tech industry, requiring specialized knowledge of its unique business models and financial metrics. Other types of investment banking may cover broader industries.

18.4. What are the main exit opportunities for technology investment bankers?

Exit opportunities include private equity, venture capital, growth equity, hedge funds, corporate finance, and corporate development. The skills gained in tech IB are highly transferable.

18.5. Which universities offer the best programs for a career in technology investment banking?

Top universities include Stanford, MIT, Harvard, and Wharton, among others. These programs provide a strong foundation in finance and technology.

18.6. How can I stay updated on the latest trends in technology investment banking?

Stay updated by reading industry news, following expert blogs, attending conferences, and visiting resources like pioneer-technology.com for the latest analysis and insights.

18.7. What is the typical career path in technology investment banking?

The typical career path starts with an analyst position, followed by associate, vice president, director, and managing director. Each role involves increasing responsibility and expertise.

18.8. How important is networking in getting a job in technology investment banking?

Networking is crucial. Building relationships with industry professionals can provide valuable insights and opportunities. Attend industry events and connect with people on LinkedIn.

18.9. What are the key challenges facing technology investment bankers today?

Key challenges include keeping up with rapid technological changes, navigating regulatory complexities, and managing risks in a volatile market.

18.10. How does pioneer-technology.com support professionals in the technology investment banking field?

Pioneer-technology.com offers detailed insights, expert analysis, and up-to-date information on the latest trends and opportunities in technology investment banking, helping professionals stay ahead.

Technology investment banking offers exciting opportunities and challenges. Stay informed and prepared with pioneer-technology.com, your go-to resource for mastering this dynamic field. Explore our articles, analysis, and expert insights to elevate your career in technology finance. Visit pioneer-technology.com now to discover the future of technology investment.

Address: 450 Serra Mall, Stanford, CA 94305, United States

Phone: +1 (650) 723-2300

Website: pioneer-technology.com