What Companies Are Leading In Battery Technology? These frontrunners are revolutionizing energy storage and powering the future of electric vehicles (EVs) and beyond. At pioneer-technology.com, we’re diving deep into the innovators who are transforming the battery landscape and impacting the renewable energy transition. Discover these pioneers in lithium-ion batteries and energy solutions, and learn how they’re shaping the future.

Table of Contents

- What Is The Current Landscape Of Battery Technology?

- Which Companies Are Leading The Charge In Battery Technology?

- How Is BYD Dominating The Integrated Battery And EV Market?

- What Makes Arcadium Lithium A Major Player In Lithium Production?

- How Is Albemarle Expanding Its Lithium Production Capacity?

- Why Is LG Energy Solution A Key Supplier For Growing EV Markets?

- What Role Does Government Funding Play In Battery Technology?

- What Are The Key Innovations In Direct Lithium Extraction (DLE)?

- How Do Material Costs Impact Battery Technology Companies?

- What Future Trends Will Shape The Battery Technology Industry?

- Frequently Asked Questions (FAQs)

1. What Is The Current Landscape Of Battery Technology?

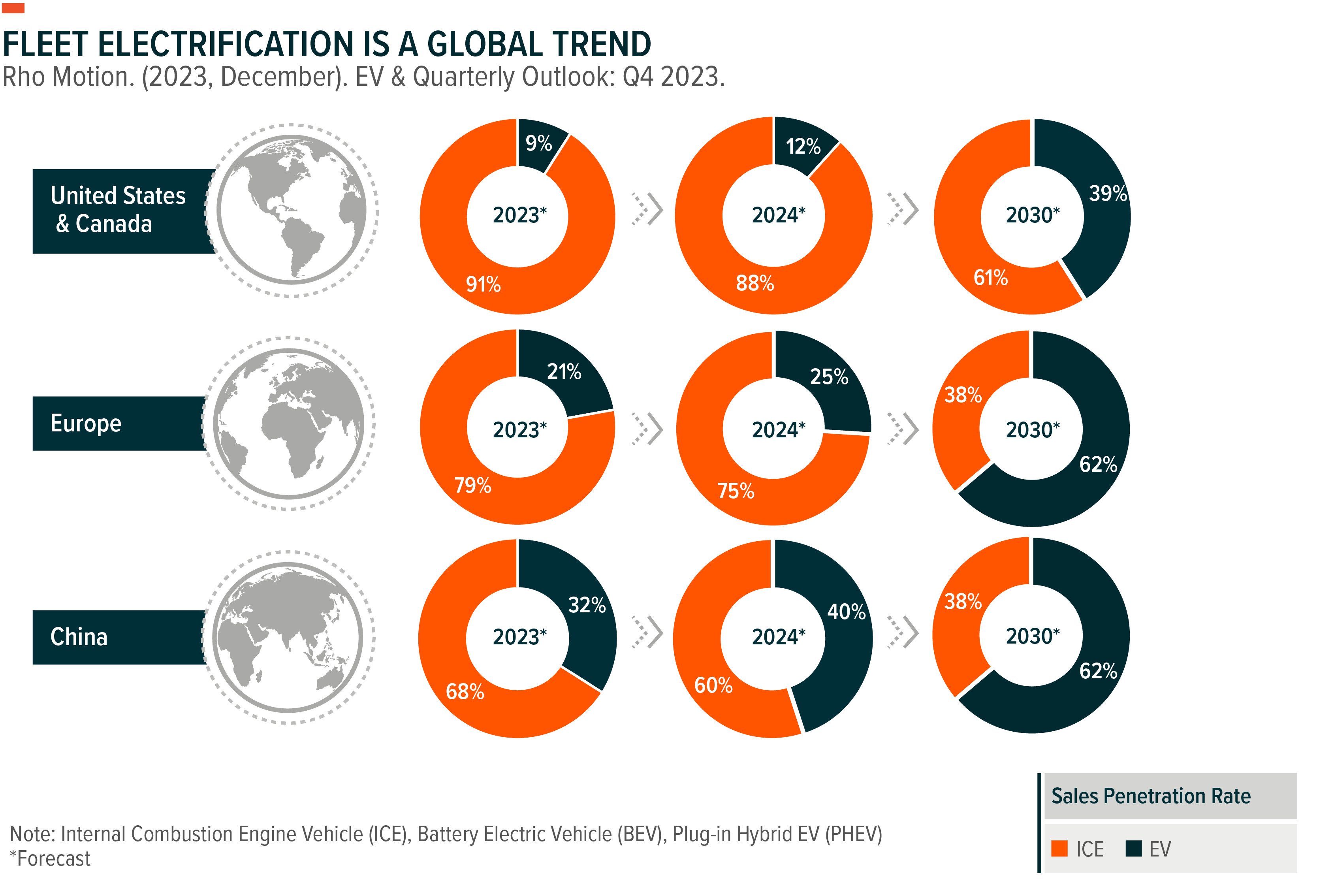

The battery technology landscape is currently experiencing a massive transformation, driven by the increasing demand for electric vehicles (EVs), renewable energy storage, and portable electronics. This surge has spurred significant innovation, research, and investment in battery technologies, making it a dynamic and rapidly evolving field. According to a report by McKinsey & Company, the global battery market is projected to reach $400 billion by 2030, highlighting the substantial growth and opportunities in this sector.

The modern battery technology landscape includes:

- Lithium-ion Batteries: These batteries dominate the EV and consumer electronics markets due to their high energy density and relatively long lifespan.

- Solid-State Batteries: Promising higher energy density and improved safety compared to lithium-ion batteries, solid-state batteries are under intense development.

- Sodium-ion Batteries: As a cost-effective and sustainable alternative, sodium-ion batteries are gaining traction, especially for grid storage applications.

- Flow Batteries: These batteries are suitable for large-scale energy storage, offering long lifespans and independent scaling of power and energy.

- Lithium-sulfur Batteries: With the potential for very high energy density, lithium-sulfur batteries are being explored for next-generation EVs and aerospace applications.

Lithium Ion Battery Components

Lithium Ion Battery Components

Lithium-ion batteries are a staple for most companies due to their high energy density and long life spans.

Key Trends Shaping the Landscape

- Increasing Energy Density: Research is focused on improving the energy density of batteries to extend the range of EVs and the runtime of electronic devices.

- Enhancing Safety: Innovations are aimed at reducing the risk of thermal runaway and improving the overall safety of batteries, particularly for EV applications.

- Reducing Costs: Efforts to lower the cost of battery production are crucial for making EVs and energy storage solutions more affordable and accessible.

- Sustainable Materials: The push for sustainable and ethically sourced battery materials is growing, driven by environmental concerns and regulatory requirements.

- Advanced Manufacturing Techniques: Innovations in manufacturing, such as dry electrode coating and advanced cell designs, are improving battery performance and reducing production costs.

Challenges in the Battery Technology Landscape

- Supply Chain Constraints: Securing a stable and reliable supply of raw materials, such as lithium, nickel, and cobalt, is a major challenge due to geopolitical factors and resource limitations.

- Performance Limitations: Improving energy density, cycle life, and charging times remain key areas of focus for ongoing research and development.

- Safety Concerns: Addressing the safety risks associated with battery technology, particularly thermal runaway and fire hazards, is critical for ensuring consumer confidence.

- Environmental Impact: Minimizing the environmental footprint of battery production, use, and disposal is essential for sustainable growth of the battery industry.

- Scalability Issues: Scaling up production of advanced battery technologies, such as solid-state and lithium-sulfur batteries, poses significant technical and logistical challenges.

The Role of Research and Development

Universities, research institutions, and private companies are investing heavily in R&D to overcome these challenges and drive innovation in battery technology. For example, the U.S. Department of Energy’s (DOE) Vehicle Technologies Office supports research projects aimed at developing next-generation battery technologies with improved performance, safety, and cost. According to research from Stanford University’s Department of Materials Science and Engineering, innovations in electrode materials and electrolyte chemistry are critical for achieving these goals.

Global Competition

The battery technology landscape is highly competitive, with major players from Asia, North America, and Europe vying for market share. Companies like CATL, LG Energy Solution, Panasonic, and Tesla are leading the way in battery manufacturing and innovation. Government policies and incentives, such as the Inflation Reduction Act (IRA) in the United States, are also playing a significant role in shaping the industry landscape.

Global Battery Market

Global Battery Market

Arcadium Lithium is a top lithium producer, alongside Albemarle, Ganfeng, and Tianqi.

The battery technology landscape is characterized by rapid innovation, intense competition, and significant investment. Addressing the challenges related to materials, performance, safety, and sustainability will be crucial for realizing the full potential of battery technology and enabling a cleaner, more sustainable energy future. Stay informed about the latest advancements and trends in battery technology at pioneer-technology.com.

2. Which Companies Are Leading The Charge In Battery Technology?

Several companies are at the forefront of battery technology, driving innovation and shaping the future of energy storage. These leaders span various aspects of the battery industry, from material production and cell manufacturing to electric vehicle integration and advanced research.

Here are some of the key players:

-

BYD (China):

- Expertise: BYD is a vertically integrated manufacturer that excels in both battery production and electric vehicle manufacturing. The company is known for its innovative Blade Battery, which uses lithium iron phosphate (LFP) chemistry to enhance safety and reduce costs.

- Market Impact: BYD’s dominance in the Chinese EV market and its growing global presence make it a significant player in the battery industry. According to a report by Counterpoint Research, BYD surpassed Tesla in Q4 2023 to become the leading seller of battery electric vehicles (BEVs) worldwide.

-

CATL (China):

- Expertise: CATL is the world’s largest battery manufacturer, supplying batteries to numerous automakers, including Tesla, BMW, and Volkswagen. The company specializes in lithium-ion batteries for EVs and energy storage systems.

- Market Impact: CATL’s extensive production capacity and advanced battery technologies have made it a critical supplier in the global EV market. The company continues to invest in R&D to develop next-generation battery technologies, such as sodium-ion batteries and solid-state batteries.

-

LG Energy Solution (South Korea):

- Expertise: LG Energy Solution is a leading battery manufacturer that provides batteries for EVs, energy storage systems, and consumer electronics. The company focuses on high-performance lithium-ion batteries with advanced safety features.

- Market Impact: LG Energy Solution has established partnerships with major automakers, including General Motors and Honda, to build battery manufacturing plants in the United States. These investments are aimed at increasing battery production capacity and supporting the growing demand for EVs in North America.

-

Panasonic (Japan):

- Expertise: Panasonic is a long-standing player in the battery industry, known for its partnership with Tesla to supply batteries for Tesla’s electric vehicles. The company also develops batteries for other applications, such as energy storage and power tools.

- Market Impact: Panasonic’s advanced battery technology and its close collaboration with Tesla have made it a key innovator in the EV market. The company is investing in the development of high-energy-density batteries and advanced manufacturing techniques to improve battery performance and reduce costs.

-

Samsung SDI (South Korea):

- Expertise: Samsung SDI develops and manufactures lithium-ion batteries for EVs, energy storage systems, and IT devices. The company focuses on high-performance batteries with enhanced safety and durability.

- Market Impact: Samsung SDI has secured partnerships with several automakers to supply batteries for their electric vehicles. The company is also investing in R&D to develop next-generation battery technologies, such as solid-state batteries and lithium-metal batteries.

-

SK Innovation (South Korea):

- Expertise: SK Innovation is a leading battery manufacturer that supplies batteries for EVs and energy storage systems. The company is known for its advanced battery technologies and its commitment to sustainability.

- Market Impact: SK Innovation has invested heavily in battery manufacturing plants in the United States and Europe to support the growing demand for EVs in these regions. The company is also focused on developing eco-friendly battery materials and recycling technologies to minimize the environmental impact of battery production.

-

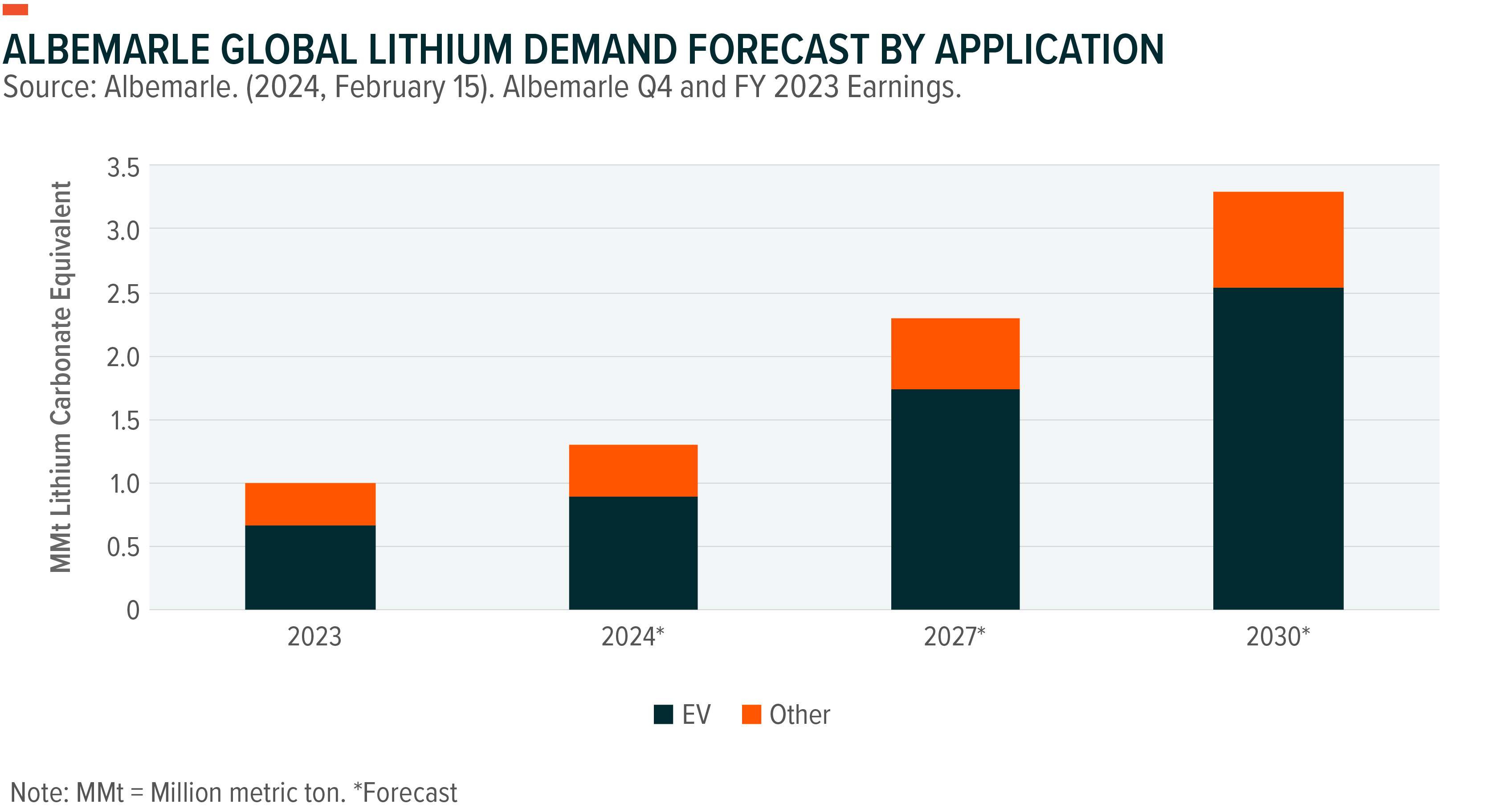

Albemarle (USA):

- Expertise: Albemarle is a global leader in lithium production, supplying lithium to battery manufacturers around the world. The company operates lithium mines and processing facilities in several countries, including Australia, Chile, and the United States.

- Market Impact: Albemarle’s extensive lithium resources and its commitment to expanding production capacity make it a critical supplier in the battery industry. The company is also involved in research and development to improve lithium extraction and processing technologies.

-

Arcadium Lithium (USA):

- Expertise: Arcadium Lithium was created by the merger of Livent and Allkem. The company has lithium production from conventional brine and hard rock mining, and lithium refining and specialty chemical production.

- Market Impact: Arcadium Lithium is expected to be the third largest lithium producer by capacity in 2027. Synergies between the business lines are expected to unlock cost savings while the placement of assets could improve logistics.

Albemarle Lithium Production

Albemarle Lithium Production

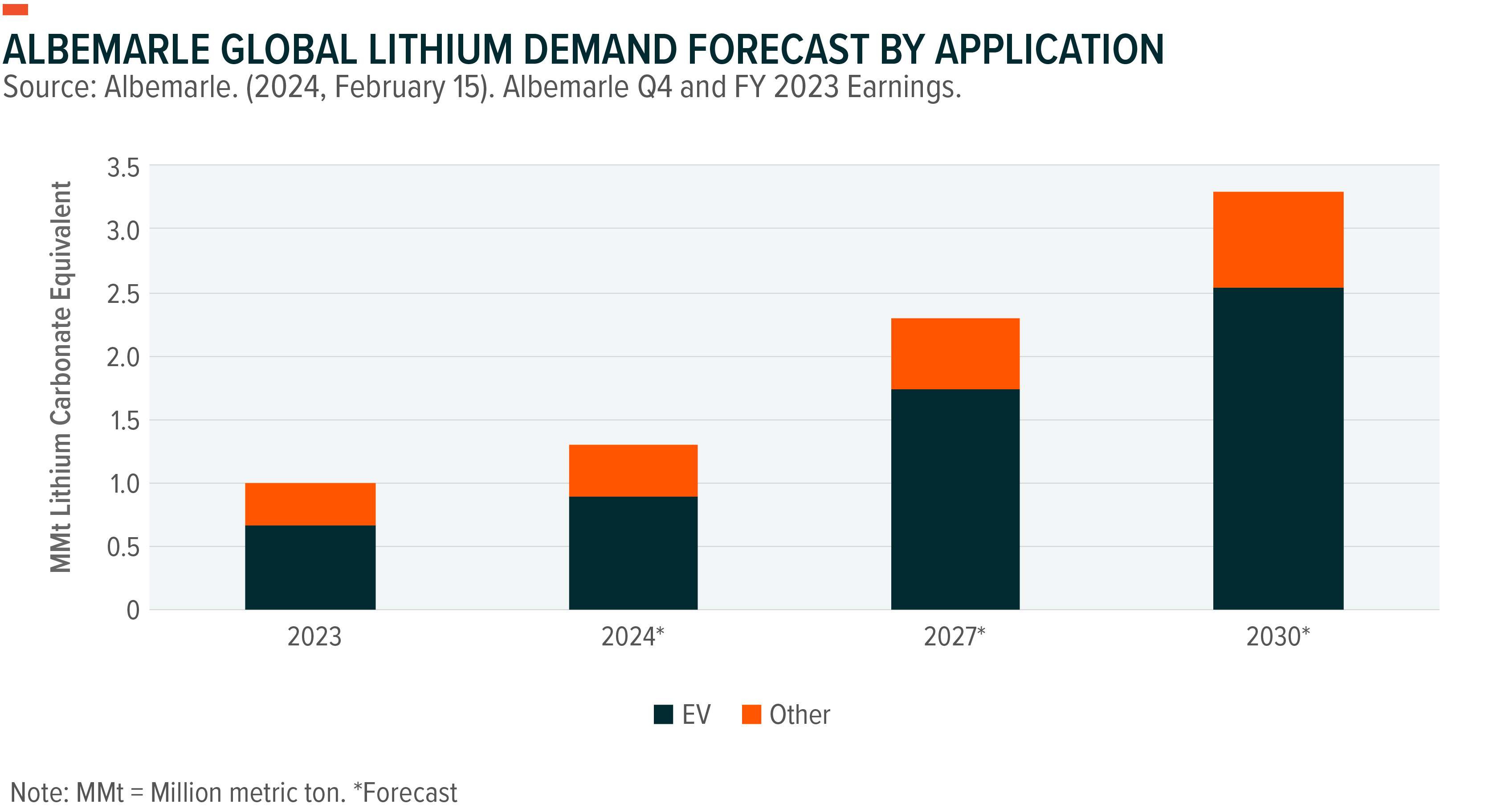

Albemarle plans to boost lithium production and conversion capacity by as much as 3x between 2022 and 2030, aligning with the company’s long-term expectations for lithium demand.

These companies are driving innovation and growth in the battery technology industry. Their expertise in battery materials, cell manufacturing, and system integration is essential for accelerating the adoption of electric vehicles and renewable energy storage. Stay updated on these industry leaders and their latest advancements at pioneer-technology.com.

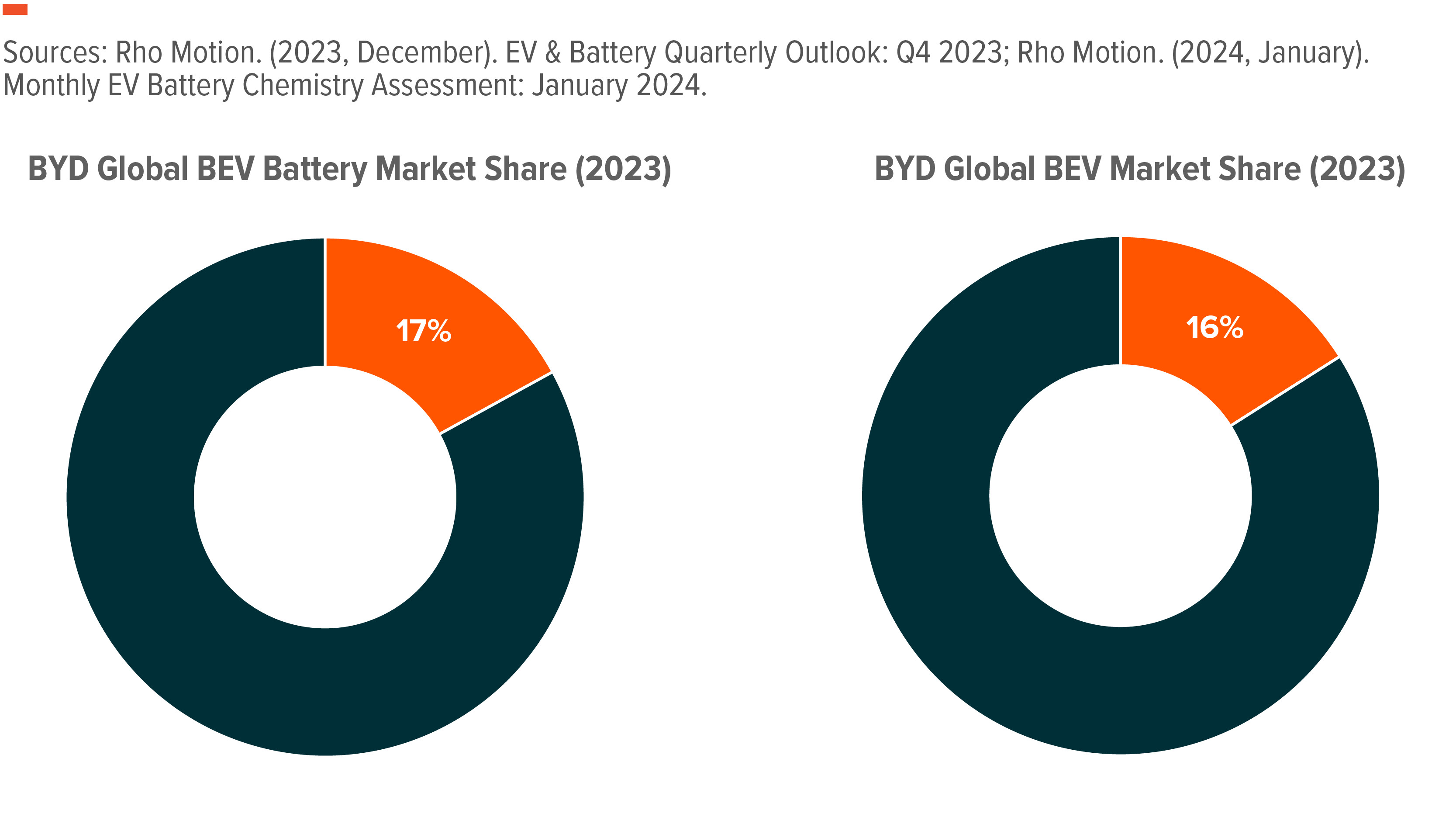

3. How Is BYD Dominating The Integrated Battery And EV Market?

BYD (Build Your Dreams) is dominating the integrated battery and EV market through its unique business model, technological innovations, and strategic market positioning. As a vertically integrated manufacturer, BYD controls key aspects of the battery and EV value chain, allowing it to reduce costs, improve efficiency, and maintain a competitive edge.

Key Factors Contributing to BYD’s Dominance:

-

Vertical Integration:

- Description: BYD’s vertical integration encompasses battery production, electric vehicle manufacturing, and even semiconductor development. This comprehensive control allows BYD to manage costs effectively and ensure a stable supply of critical components.

- Impact: By producing its own batteries and semiconductors, BYD reduces its reliance on external suppliers, mitigates supply chain risks, and achieves economies of scale. This integration enables BYD to offer competitive pricing and maintain high-quality standards.

-

Battery Technology Leadership:

- Description: BYD is renowned for its innovative battery technologies, particularly the Blade Battery. This lithium iron phosphate (LFP) battery features a unique design that enhances safety, increases energy density, and reduces costs.

- Impact: The Blade Battery’s superior safety and cost-effectiveness have made it a popular choice for EVs, contributing to BYD’s strong sales and market share. BYD’s LFP battery expertise has also attracted partnerships with other automakers, further expanding its influence in the battery market.

-

Cost-Effective EV Models:

- Description: BYD offers a range of affordable EV models, such as the Seagull and Dolphin, which are among the least expensive EVs in the world. These models cater to a broad customer base and drive volume sales.

- Impact: BYD’s ability to produce cost-effective EVs has made electric mobility more accessible to consumers, accelerating the adoption of EVs and strengthening BYD’s market position.

-

Market Share and Sales Growth:

- Description: BYD has achieved remarkable sales growth in recent years, surpassing Tesla in Q4 2023 to become the leading seller of battery electric vehicles (BEVs) worldwide. The company’s strong sales performance reflects its competitive product lineup and effective market strategies.

- Impact: BYD’s growing market share and sales volume demonstrate its ability to compete with established automakers and capitalize on the increasing demand for EVs. This success has solidified BYD’s position as a dominant player in the global EV market.

-

Global Expansion:

- Description: BYD is expanding its global presence through exports and strategic investments in overseas markets. The company plans to build a factory in Szeged, Hungary, to serve the European market.

- Impact: BYD’s global expansion efforts will enable it to reach new customers, diversify its revenue streams, and establish a stronger foothold in key EV markets around the world.

-

Profitability and Margin Improvement:

- Description: BYD has achieved significant improvements in profitability and net profit margin, driven by its vertical integration and cost-control measures. The company’s net profit margin increased by nearly 70% between Q3 2022 and Q3 2023.

- Impact: BYD’s strong financial performance demonstrates the effectiveness of its business model and its ability to generate sustainable profits in the competitive EV market. This profitability enables BYD to reinvest in R&D, expand its production capacity, and further strengthen its market position.

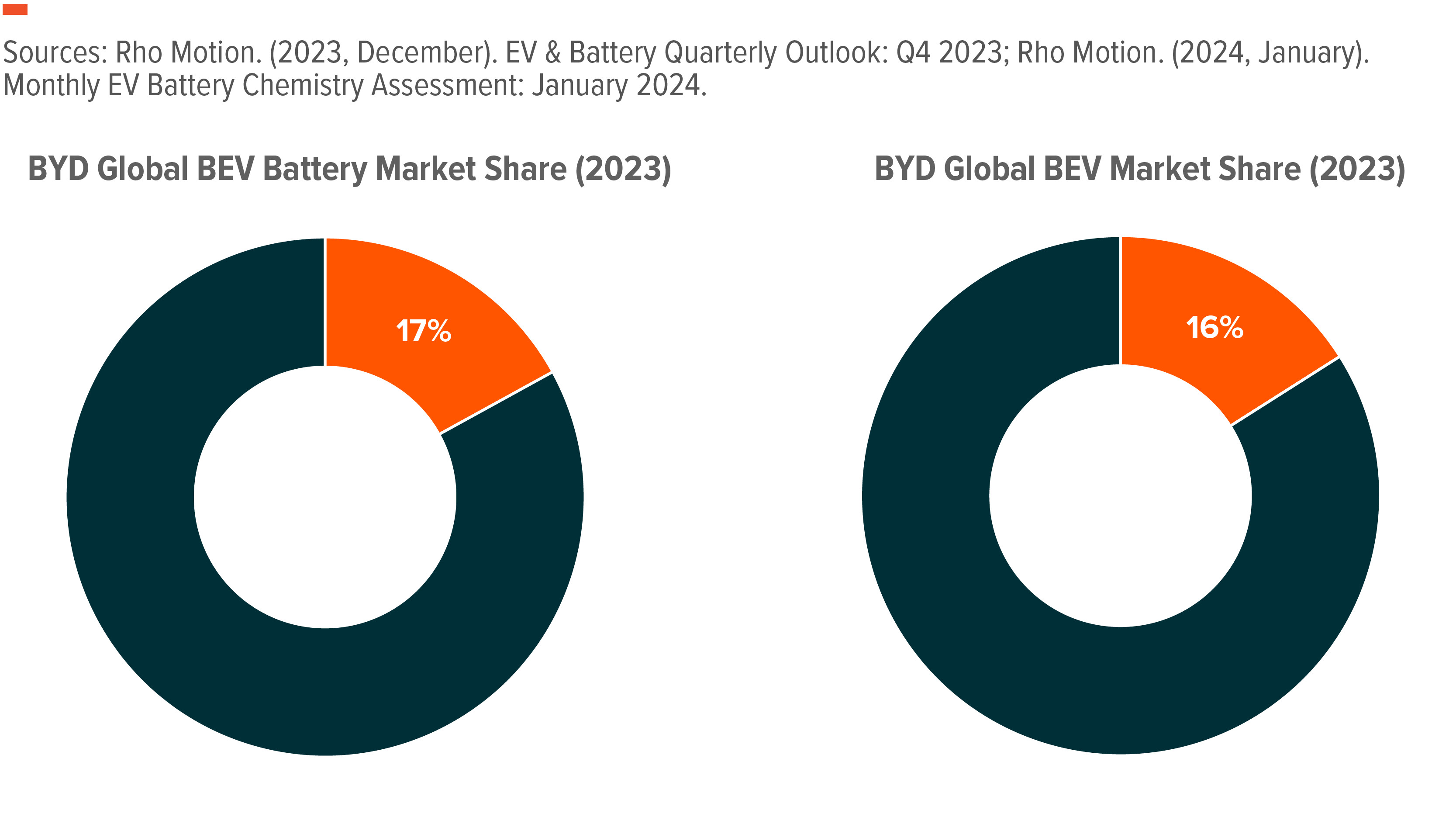

BYD Market Share

BYD Market Share

BYD is making waves as the third largest EV battery maker by market share.

BYD’s dominance in the integrated battery and EV market is a result of its vertical integration, battery technology leadership, cost-effective EV models, and strategic market positioning. These factors have enabled BYD to achieve remarkable sales growth, improve profitability, and establish a strong global presence. As the demand for EVs continues to rise, BYD is well-positioned to maintain its leadership and drive the transition to electric mobility. Stay informed about BYD’s latest innovations and market strategies at pioneer-technology.com.

4. What Makes Arcadium Lithium A Major Player In Lithium Production?

Arcadium Lithium has emerged as a major player in lithium production through strategic mergers, comprehensive lithium product offerings, and a focus on sustainable and efficient extraction technologies. Formed by the merger of Livent and Allkem, Arcadium Lithium combines the strengths of both companies to create a lithium giant with a global presence and diverse capabilities.

Key Factors Contributing to Arcadium Lithium’s Prominence:

-

Merger of Livent and Allkem:

- Description: The merger of Livent and Allkem in early 2024 created Arcadium Lithium, one of the largest lithium producers in the world. This merger combined Allkem’s expertise in lithium production from conventional brine and hard rock mining with Livent’s lithium refining and specialty chemical production capabilities.

- Impact: The merger has enabled Arcadium Lithium to offer a comprehensive range of lithium products, including spodumene, carbonate, and hydroxide. This diversification strengthens Arcadium Lithium’s position in the market and allows it to serve a broader customer base.

-

Comprehensive Lithium Product Offerings:

- Description: Arcadium Lithium offers a full suite of lithium products, catering to various applications and customer requirements. This includes lithium carbonate, lithium hydroxide, spodumene concentrate, and specialty lithium compounds.

- Impact: The ability to provide a wide range of lithium products enhances Arcadium Lithium’s competitiveness and allows it to capture a larger share of the lithium market. This comprehensive offering also enables Arcadium Lithium to build stronger relationships with its customers.

-

Geographic Diversification:

- Description: Arcadium Lithium has a geographically diverse asset portfolio, with operations in Argentina, Australia, Canada, the United Kingdom, and China. This diversification reduces the company’s exposure to regional risks and ensures a stable supply of lithium.

- Impact: The geographically diverse asset base provides Arcadium Lithium with flexibility in sourcing lithium and serving its global customer base. This diversification also positions Arcadium Lithium to benefit from regional growth opportunities and government incentives.

-

Focus on Direct Lithium Extraction (DLE):

- Description: Arcadium Lithium is actively involved in the development and deployment of direct lithium extraction (DLE) technologies. DLE technologies offer a more sustainable and efficient alternative to traditional lithium extraction methods, reducing water consumption and environmental impact.

- Impact: The adoption of DLE technologies enhances Arcadium Lithium’s sustainability profile and reduces its environmental footprint. This focus on sustainable extraction methods aligns with the growing demand for ethically sourced and environmentally friendly lithium.

-

Strategic Partnerships and Acquisitions:

- Description: Arcadium Lithium has formed strategic partnerships and made acquisitions to strengthen its position in the lithium market. For example, Livent acquired a minority stake in ILiAD Technologies, a DLE technology firm, to enhance its DLE capabilities.

- Impact: Strategic partnerships and acquisitions enable Arcadium Lithium to access new technologies, expand its production capacity, and strengthen its relationships with key stakeholders. These initiatives contribute to Arcadium Lithium’s long-term growth and success.

-

Compliance with Inflation Reduction Act (IRA):

- Description: Arcadium Lithium’s supply chain is strategically positioned to benefit from the Inflation Reduction Act (IRA) in the United States. The IRA provides incentives for EV and battery manufacturing, requiring a minimum threshold of minerals to be produced or processed domestically or in countries with free trade agreements with the U.S.

- Impact: Arcadium Lithium’s production capacity aligns with IRA sourcing requirements, making its lithium more attractive to customers seeking to qualify for IRA incentives. This compliance enhances Arcadium Lithium’s competitiveness in the North American market and supports the growth of its EV battery business.

BYD Market Share

BYD Market Share

The Inflation Reduction Act (IRA) has created incentives for EV and battery manufacturing, which benefit LG Energy Solution.

Arcadium Lithium’s position as a major player in lithium production is driven by its strategic merger, comprehensive product offerings, geographic diversification, focus on DLE technologies, and compliance with the IRA. These factors enable Arcadium Lithium to meet the growing demand for lithium in a sustainable and efficient manner, supporting the transition to electric vehicles and renewable energy storage. Stay informed about Arcadium Lithium’s latest developments and initiatives at pioneer-technology.com.

5. How Is Albemarle Expanding Its Lithium Production Capacity?

Albemarle, a global leader in lithium production, is aggressively expanding its lithium production capacity to meet the growing demand for lithium in the electric vehicle (EV) and energy storage markets. The company’s expansion strategy involves increasing production at existing sites, developing new projects, and forming strategic partnerships.

Key Strategies for Expanding Lithium Production Capacity:

-

Expansion of Existing Projects:

- Description: Albemarle is expanding its production capacity at existing lithium projects, such as Greenbushes and Wodgina in Australia, and improving efficiency at its South American projects. These expansions are expected to boost Albemarle’s lithium output in the near term.

- Impact: Expanding existing projects allows Albemarle to leverage its established infrastructure, expertise, and resources to increase production capacity quickly and cost-effectively. This strategy enables Albemarle to meet the immediate demand for lithium while developing new projects for long-term growth.

-

Development of New Lithium Projects:

- Description: Albemarle is developing new lithium projects in the United States, including the King’s Mountain project in North Carolina and the Magnolia project in Arkansas. These projects are expected to contribute significantly to Albemarle’s lithium production in the second half of the decade.

- Impact: Developing new lithium projects diversifies Albemarle’s lithium sources and reduces its reliance on a few key locations. These projects also position Albemarle to benefit from government incentives and support for domestic lithium production in the United States.

-

Strategic Partnerships and Offtake Agreements:

- Description: Albemarle is forming strategic partnerships and offtake agreements with automakers and other companies to secure long-term lithium supply contracts. For example, Albemarle has a definitive agreement with Ford to supply 100,000 metric tons of battery-grade lithium hydroxide between 2026 and 2030.

- Impact: Strategic partnerships and offtake agreements provide Albemarle with revenue visibility and reduce the risk associated with lithium price fluctuations. These agreements also strengthen Albemarle’s relationships with key customers and support the growth of its lithium business.

-

Investment in Technology and Innovation:

- Description: Albemarle is investing in technology and innovation to improve its lithium extraction and processing technologies. This includes research and development in direct lithium extraction (DLE) and other advanced methods.

- Impact: Investing in technology and innovation enhances Albemarle’s efficiency, reduces its environmental impact, and enables it to extract lithium from unconventional sources. This focus on innovation strengthens Albemarle’s competitive position and supports its long-term growth.

-

Government Funding and Support:

- Description: Albemarle has received government funding and support for its lithium projects in the United States. For example, Albemarle has received $240 million in government grants and loans to support the development of the King’s Mountain project.

- Impact: Government funding and support reduce Albemarle’s capital costs and accelerate the development of its lithium projects. This support also aligns with the U.S. government’s efforts to increase domestic production of critical materials for the EV and energy storage industries.

-

Sustainability Initiatives:

- Description: Albemarle is committed to sustainable lithium production and is implementing various initiatives to reduce its environmental footprint. This includes reducing water consumption, minimizing waste, and engaging with local communities.

- Impact: Sustainability initiatives enhance Albemarle’s reputation, reduce its environmental impact, and improve its relationships with stakeholders. These initiatives also align with the growing demand for ethically sourced and environmentally friendly lithium.

Global Battery Market

Global Battery Market

Expansions to current lithium projects, such as Greenbushes and Wodgina in Australia could be Albemarle’s growth engine in the coming years.

Albemarle is expanding its lithium production capacity through a combination of expanding existing projects, developing new projects, forming strategic partnerships, investing in technology and innovation, and leveraging government support. These strategies enable Albemarle to meet the growing demand for lithium, strengthen its competitive position, and support the transition to electric vehicles and renewable energy storage. Stay informed about Albemarle’s latest expansion initiatives and projects at pioneer-technology.com.

6. Why Is LG Energy Solution A Key Supplier For Growing EV Markets?

LG Energy Solution has become a key supplier for growing electric vehicle (EV) markets due to its advanced battery technology, strategic partnerships with major automakers, and global manufacturing footprint. As one of the world’s leading battery manufacturers, LG Energy Solution provides high-performance batteries that are essential for the widespread adoption of EVs.

Key Factors Contributing to LG Energy Solution’s Prominence:

-

Advanced Battery Technology:

- Description: LG Energy Solution develops and manufactures advanced lithium-ion batteries with high energy density, long cycle life, and enhanced safety features. These batteries are designed to meet the demanding requirements of electric vehicles, providing long driving ranges and reliable performance.

- Impact: LG Energy Solution’s advanced battery technology enables automakers to produce EVs with competitive performance and range, attracting a broader customer base and accelerating the adoption of electric mobility.

-

Strategic Partnerships with Automakers:

- Description: LG Energy Solution has established strategic partnerships with major automakers, including General Motors, Honda, Hyundai, Volkswagen, Tesla, and Stellantis. These partnerships involve joint ventures to build battery manufacturing plants and long-term supply agreements for battery cells and modules.

- Impact: Strategic partnerships with automakers provide LG Energy Solution with guaranteed demand for its batteries and enable it to expand its production capacity to meet the growing needs of the EV market. These partnerships also foster collaboration and innovation in battery technology and EV development.

-

Global Manufacturing Footprint:

- Description: LG Energy Solution has a global manufacturing footprint with production facilities in South Korea, China, Poland, and the United States. This global presence allows LG Energy Solution to serve customers in key EV markets around the world.

- Impact: A global manufacturing footprint enables LG Energy Solution to reduce transportation costs, mitigate supply chain risks, and respond quickly to changes in market demand. This global presence also positions LG Energy Solution to benefit from government incentives and support for domestic battery production in various countries.

-

Long-Term Supply Agreements:

- Description: LG Energy Solution has secured long-term supply agreements with automakers, providing a stable revenue stream and enabling it to plan its production capacity effectively. For example, LG Energy Solution has a long-term agreement to supply Toyota with American-made nickel-based batteries from 2025.

- Impact: Long-term supply agreements provide LG Energy Solution with revenue visibility and reduce the risk associated with market fluctuations. These agreements also strengthen LG Energy Solution’s relationships with its customers and support the growth of its battery business.

-

Benefits from Government Incentives:

- Description: LG Energy Solution benefits from government incentives, such as those provided by the Inflation Reduction Act (IRA) in the United States. The IRA provides incentives for EV and battery manufacturing, encouraging companies to invest in domestic production and create jobs.

- Impact: Government incentives reduce LG Energy Solution’s capital costs and improve its profitability. These incentives also support LG Energy Solution’s expansion plans and enable it to compete effectively in the global battery market.

-

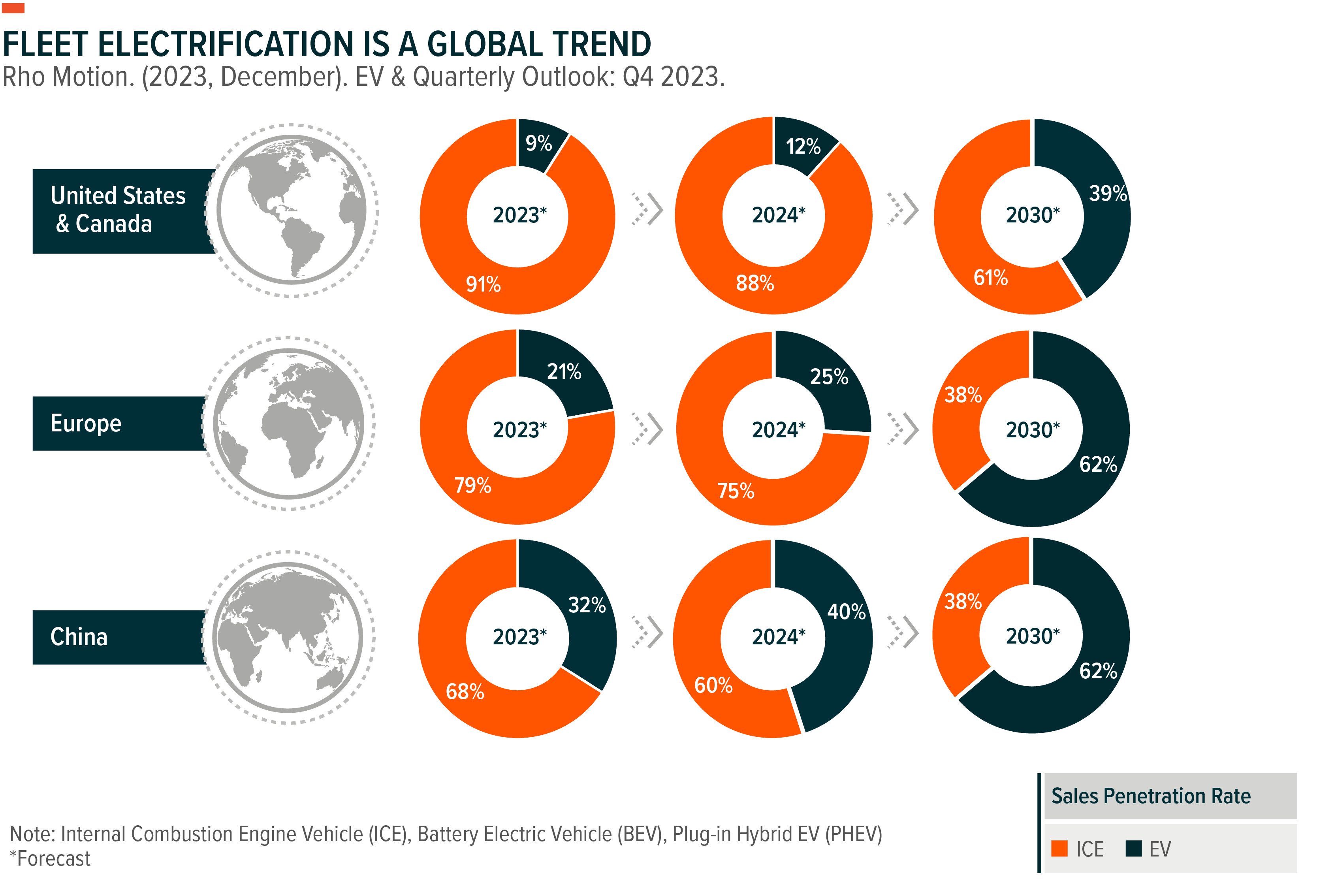

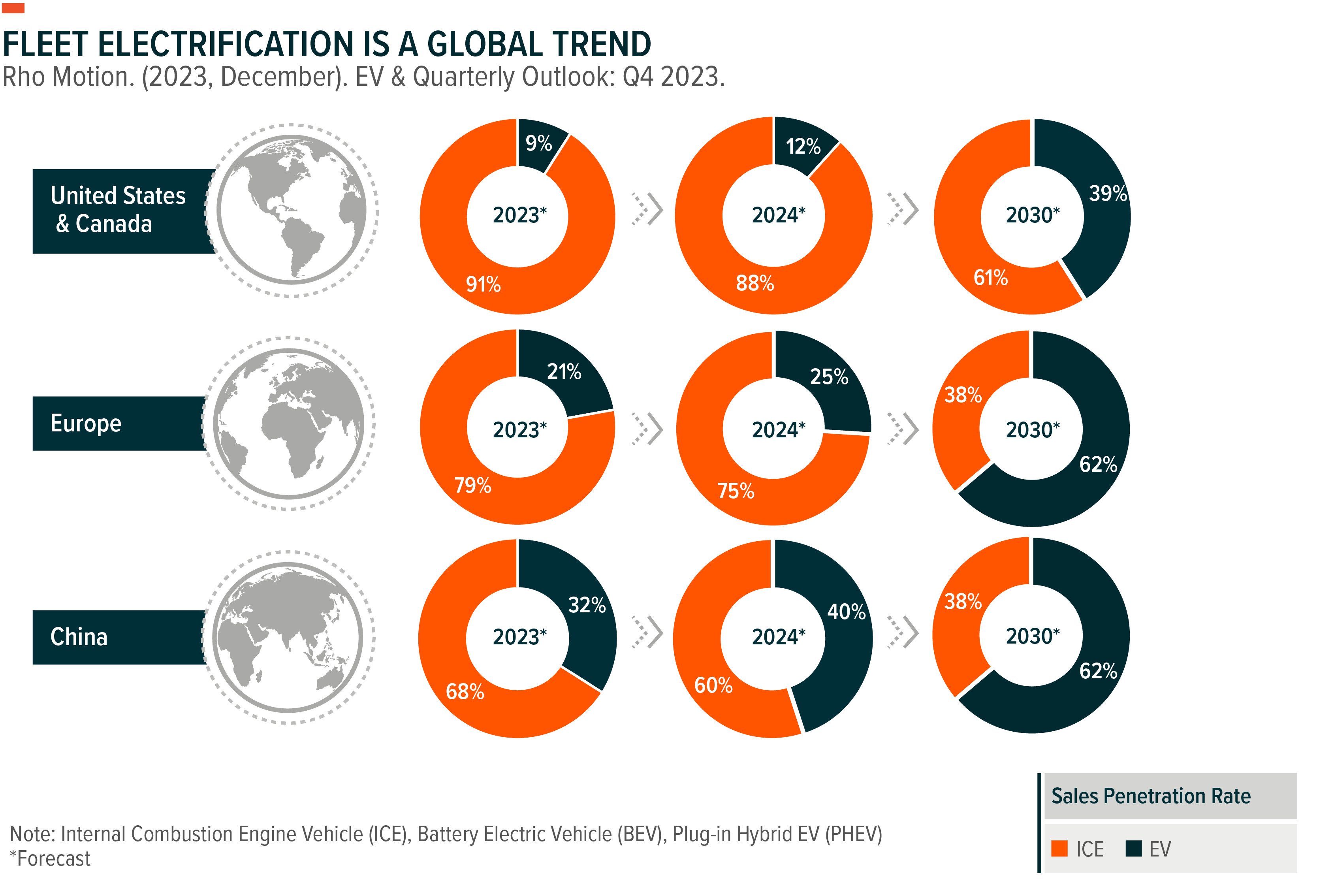

Customer Base in Growing EV Markets:

- Description: LG Energy Solution’s customer base includes automakers that are expected to be among the top EV producers in the coming years. Rho Motion forecasts that LG Energy Solution’s top clients will comprise 39% of the global BEV market in 2030.

- Impact: A strong customer base in growing EV markets ensures that LG Energy Solution will continue to be a key supplier for the EV industry. This positioning enables LG Energy Solution to capitalize on the increasing demand for EVs and maintain its leadership in the battery market.

BYD Market Share

BYD Market Share

LG Energy Solution’s top clients by battery volume include strategically significant automakers like Volkswagen, Tesla, Stellantis, GM, and Ford.

LG Energy Solution’s role as a key supplier for growing EV markets is driven by its advanced battery technology, strategic partnerships with automakers, global manufacturing footprint, long-term supply agreements, and benefits from government incentives. These factors enable LG Energy Solution to meet the increasing demand for high-performance batteries, support the growth of the EV industry, and maintain its leadership in the battery market. Stay informed about LG Energy Solution’s latest developments and partnerships at pioneer-technology.com.

7. What Role Does Government Funding Play In Battery Technology?

Government funding plays a pivotal role in advancing battery technology by supporting research and development, promoting domestic manufacturing, and accelerating the deployment of energy storage solutions. Governments around the world are recognizing the strategic importance of battery technology for achieving energy independence, reducing carbon emissions, and fostering economic growth.

Key Ways Government Funding Supports Battery Technology:

-

Research and Development (R&D) Grants:

- Description: Governments provide grants and funding to universities, research institutions, and private companies to support R&D in battery technology. These grants fund projects aimed at improving battery performance, reducing costs, enhancing safety, and developing new battery chemistries.

- Impact: R&D grants accelerate innovation in battery technology, leading to breakthroughs in materials science, cell design, and manufacturing processes. These advancements enhance the competitiveness of domestic battery industries and support the development of next-generation energy storage solutions.

- Example: The U.S. Department of Energy (DOE) provides funding through its Vehicle Technologies Office and Advanced Research Projects Agency-Energy (ARPA-E) to support battery R&D projects across the country.

-

Manufacturing Incentives and Subsidies:

- Description: Governments offer incentives and subsidies to encourage companies to establish and expand battery manufacturing facilities within their borders. These incentives can include tax breaks, low-interest loans, and direct financial support.

- Impact: Manufacturing incentives attract investments in domestic battery production, creating jobs and reducing reliance on foreign suppliers. These incentives also help to lower the cost of battery manufacturing, making energy storage solutions more affordable and accessible.

- Example: The Inflation Reduction Act (IRA) in the United States provides tax credits and other incentives for battery manufacturing, encouraging companies to invest in domestic production and create jobs.

-

Infrastructure Development:

- Description: Governments invest in infrastructure to support the deployment of battery technology, such as charging stations for electric vehicles and grid-scale energy storage systems. These investments can include funding for pilot projects, demonstration programs, and large-scale infrastructure deployments.

- Impact: Infrastructure investments create demand for battery technology, driving innovation and market growth. These investments also support the adoption of electric vehicles and renewable energy, helping to reduce carbon emissions and improve air quality.

- Example: The Bipartisan Infrastructure Law in the United States provides funding for EV charging infrastructure and grid-scale energy storage projects, supporting the deployment of battery technology across the country.

-

Standards and Regulations:

- Description: Governments establish standards and regulations to ensure the safety, performance, and environmental sustainability of battery technology. These standards can include requirements for battery testing, labeling, and recycling.

- Impact: Standards and regulations promote the responsible development and deployment of battery technology, protecting consumers and the environment. These standards also create a level playing field for battery manufacturers, encouraging innovation and competition.

- Example: The European Union’s Battery Directive sets requirements for the collection, treatment, and recycling of batteries, promoting the circular economy and reducing the environmental impact of battery production.

-

Workforce Development:

- Description: Governments invest in workforce development programs to train workers for jobs in the battery industry. These programs can include vocational training, apprenticeships, and degree programs in battery technology and related fields.

- Impact: Workforce development programs ensure that there is a skilled workforce available to support the growth of the battery industry. These programs also create opportunities for workers to gain new skills and advance their careers in a growing and dynamic sector.

- Example: The U.S. Department of Labor provides funding for workforce development programs in battery technology and related fields, helping to train workers for jobs in the growing clean energy economy.

Albemarle Lithium Production

Albemarle Lithium Production

Albemarle has received $240 million in government grants and loans to support the development at King’s Mountain.

Government funding plays a critical role in advancing battery technology by supporting R&D, promoting domestic manufacturing, investing in infrastructure, establishing standards and regulations, and developing the workforce. These investments accelerate innovation, reduce costs, enhance safety, and promote the responsible development and deployment of battery technology, supporting the transition to a cleaner, more sustainable energy future. Stay informed about government initiatives and funding opportunities in battery technology at pioneer-technology.com.

8. What Are The Key Innovations In Direct Lithium Extraction (DLE)?

Direct Lithium Extraction (DLE) technologies are revolutionizing the lithium extraction process by offering more efficient, sustainable, and environmentally friendly alternatives to traditional methods like evaporation ponds and hard rock mining. DLE technologies extract lithium directly from brine resources without the need for prolonged evaporation, significantly reducing water consumption and environmental impact.

Key Innovations in Direct Lithium Extraction (DLE):

-

Adsorption:

- Description: Adsorption DLE technologies use selective adsorbents to capture lithium ions from brine. The lithium-loaded adsorbent is then treated to release the lithium, which is further processed to produce battery-grade lithium compounds.

- Advantages: High lithium recovery rates, reduced water consumption, and minimal environmental impact.

- Companies Involved: Lilac Solutions, Standard Lithium.

-

Ion Exchange:

- Description: Ion exchange DLE technologies use ion exchange resins to selectively capture lithium ions from brine. The lithium-loaded resin is then eluted to release the lithium, which is further processed to produce battery-grade lithium compounds.

- Advantages: High selectivity for lithium, efficient extraction process, and reduced waste generation.

- Companies Involved: EnergySource Minerals, Adionics.

-

Solvent Extraction:

- Description: Solvent extraction DLE technologies use organic solvents to selectively extract lithium ions from brine. The lithium-loaded solvent is then stripped to release the lithium, which is further processed to produce battery-grade lithium compounds.

- Advantages: High lithium recovery rates, ability to process brines with high impurity levels, and relatively low energy consumption.

- Companies Involved: Lake Resources, E3 Lithium.

-

Membrane Separation:

- Description: Membrane separation DLE technologies use selective membranes to separate lithium ions from brine. The lithium ions pass through the membrane, while other ions are retained, resulting in a lithium-rich solution that is further processed to produce battery-grade lithium compounds.

- Advantages: High selectivity for lithium, continuous operation, and minimal chemical consumption.

- Companies Involved: NanoH2O (now part of LG Chem), Altilium.

-

Hybrid DLE Technologies:

- Description: Hybrid DLE technologies combine two or more DLE methods to enhance lithium extraction efficiency and reduce costs. These technologies can involve integrating adsorption, ion exchange, solvent extraction, and membrane separation processes.

- Advantages: Improved lithium recovery rates, reduced water consumption, and enhanced process flexibility.

- Companies Involved: Arcadium Lithium (DLE-augmented process).

Benefits of Direct Lithium Extraction (DLE):

- Reduced Water Consumption: DLE technologies significantly reduce water consumption compared to traditional evaporation ponds, which can consume large volumes of water in arid regions.

- Lower Environmental Impact: DLE technologies minimize the environmental impact of lithium extraction by reducing land use, waste generation, and chemical consumption.

- Faster Production Times: DLE technologies enable faster lithium production times compared to traditional methods, which can take months or years to produce battery-grade lithium compounds.

- Higher Lithium Recovery Rates: DLE technologies can achieve higher lithium recovery rates compared to traditional methods, maximizing the utilization of lithium resources.

- Ability to Process Unconventional Brines: DLE technologies can process brines with high impurity levels or low lithium concentrations, expanding the range of lithium resources that can be economically exploited.

Lithium Ion Battery Components

Lithium Ion Battery Components

Direct Lithium Extraction (DLE) technologies can also be used to produce Lithium-ion batteries.

Direct Lithium Extraction (DLE) technologies are driving innovation and sustainability in the lithium extraction industry. These technologies offer significant advantages over traditional methods, including reduced water consumption, lower environmental impact, faster production times, higher lithium recovery rates, and the ability to process unconventional brines. As the demand for lithium continues to grow, DLE technologies will play an increasingly important role in ensuring a sustainable and secure supply of this critical material. Stay informed about the latest advancements in DLE technologies at pioneer-technology.com.

9. How Do Material Costs Impact Battery Technology Companies?

Material costs have a significant impact on battery technology companies, influencing their profitability, competitiveness, and ability to innovate. The cost of raw materials, such as lithium, nickel, cobalt, and manganese, accounts for a substantial portion of the total cost of battery production